ad valorem tax florida exemption

Save Time Signing Documents from Any Device. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION.

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

. Florida Administrative Code. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

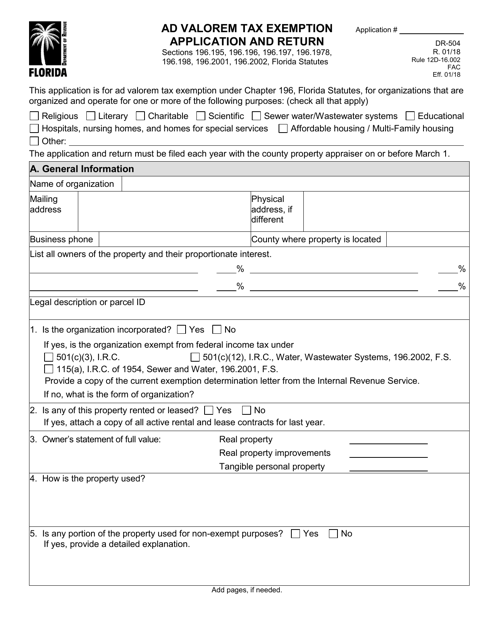

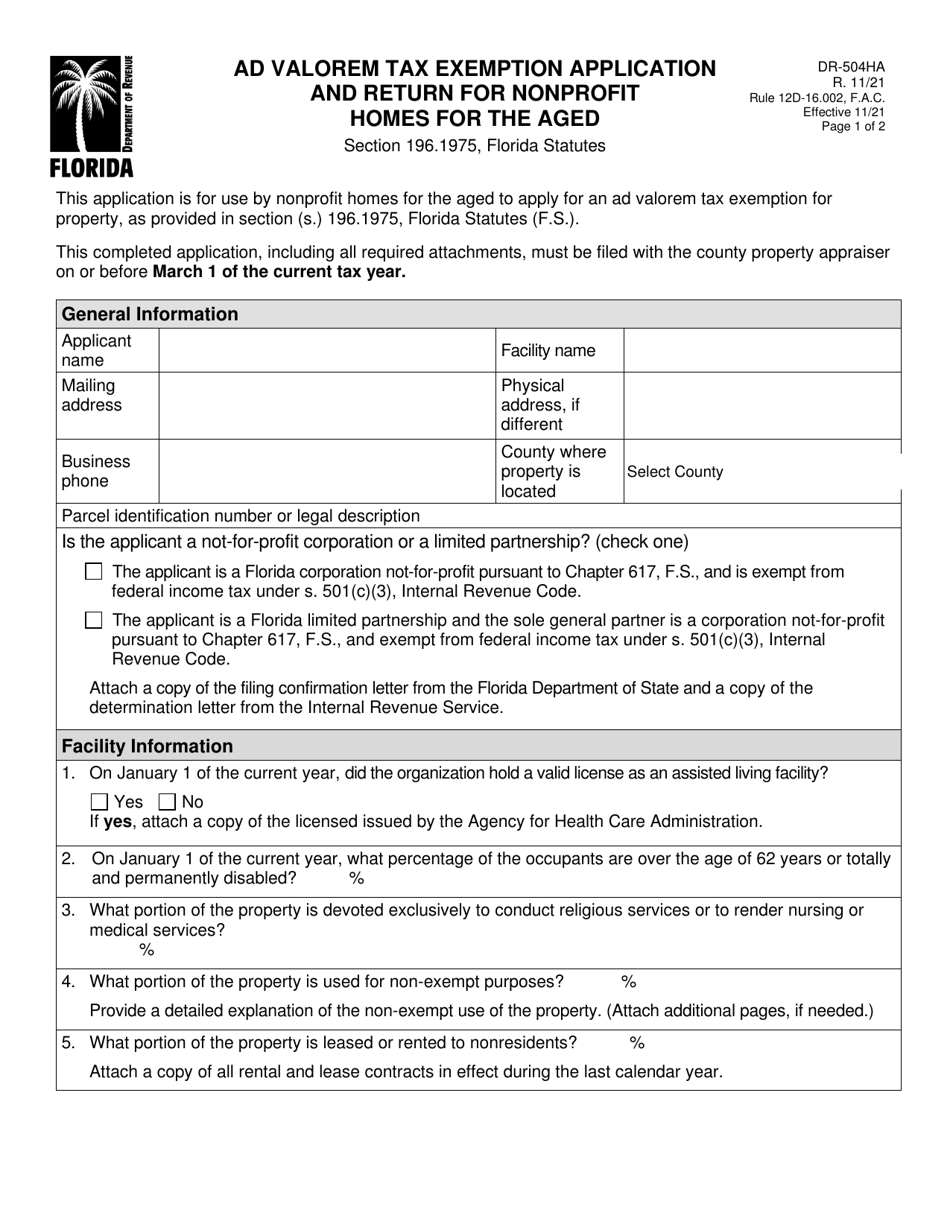

The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average salaries to locate here. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS. HOMES FOR THE AGED.

The exemption applies only to improvements to real property. A veteran who was honorably discharged from the armed forces and who sustained a service-connected total and permanent disability can qualify for exemption from all ad valorem taxes on his or her homesteaded property. The exemption may remain in effect.

3 The ordinance shall designate the type and location of historic property for which exemptions may be granted. Exemption for certain permanently and totally disabled veterans and for surviving spouses of veterans. Additional homestead exemption for persons 65 and older.

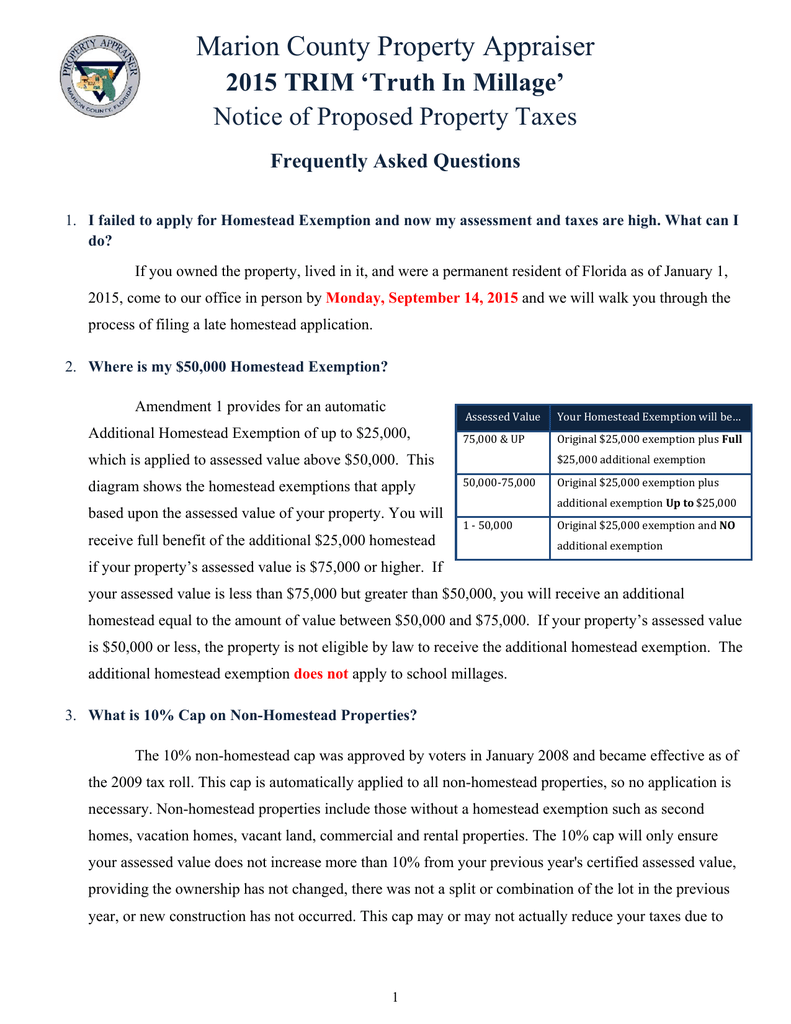

Check all that apply. This completed application including all required attachments must be filed with the county property appraiser on or before March 1 of the current tax year. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property.

Be a permanent resident of Florida on January 1 of the year that he or she is applying. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

196199 Government property exemption. The 2021 Florida Statutes. Sections 196195 196196 and 196197 Florida Statutes.

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances allowing a property tax exemption for up to 100 of the increase in assessed improvements resulting from an approved rehabilitation of a qualified historic property. The program enables Pinellas County to more effectively stimulate job creation. HOMES AND HOMES FOR SPECIAL SERVICES.

Claims by members of armed forces. All property of the United States is exempt from ad valorem taxation except such property as is subject to tax by this state or any political subdivision thereof or any municipality under any law of the United States. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. Exemption for surviving spouses of first responders who die in the line of duty. Further benefits are available to property owners with disabilities senior citizens veterans and active.

Property Tax Exemption for Historic Properties. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. The Ad-Valorem Tax Exemption is an incentive that is provided by state and county law that is intended to encourage the rehabilitation and maintenance of historic structures.

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE RELIGIOUS SCIENTIFIC LITERARY ORGANIZATIONS HOSPITALS NURSING. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Ad-Valorem Tax Exemption - Miami-Dade County.

In order for the property to qualify for the exemption any such improvements must be made on or after the day the ordinance authorizing ad valorem tax exemption for historic properties is adopted.

On Line Extra Marion County Property Appraiser

Florida Homestead Exemption Martindale Com

Florida S Ad Valorem Tax Exemption Dean Mead

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

What Is A Homestead Exemption And How Does It Work Lendingtree

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Florida Homestead Exemption Chrisluis Com

Understanding Your Tax Bill Seminole County Tax Collector

Exemptions Hardee County Property Appraiser

A Guide To Your Property Tax Bill Alachua County Tax Collector

Real Estate Taxes City Of Palm Coast Florida

How To File For Florida Homestead Exemption Florida Agency Network

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged 2021 Templateroller

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

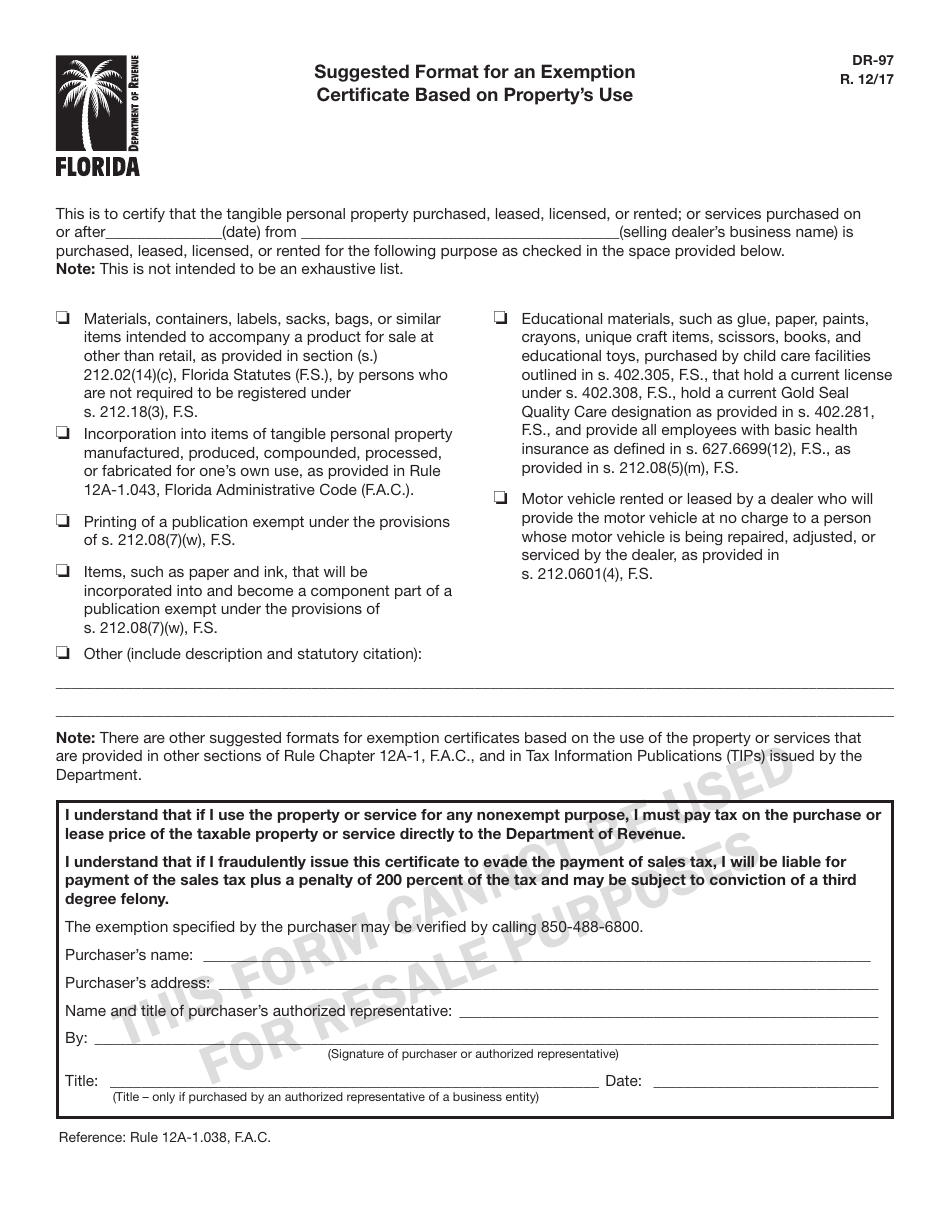

Form Dr 97 Download Printable Pdf Or Fill Online Suggested Format For An Exemption Certificate Based On Property S Use Florida Templateroller