when will the housing market slow down again

Housing market slows down a bitbut its still hot Fortune. Then Lehman Brothers went under on September 15 2008 a full two and a half years after the housing market peaked.

Pin On Real Estate Insights And More

After all were only entering the fall of 2021.

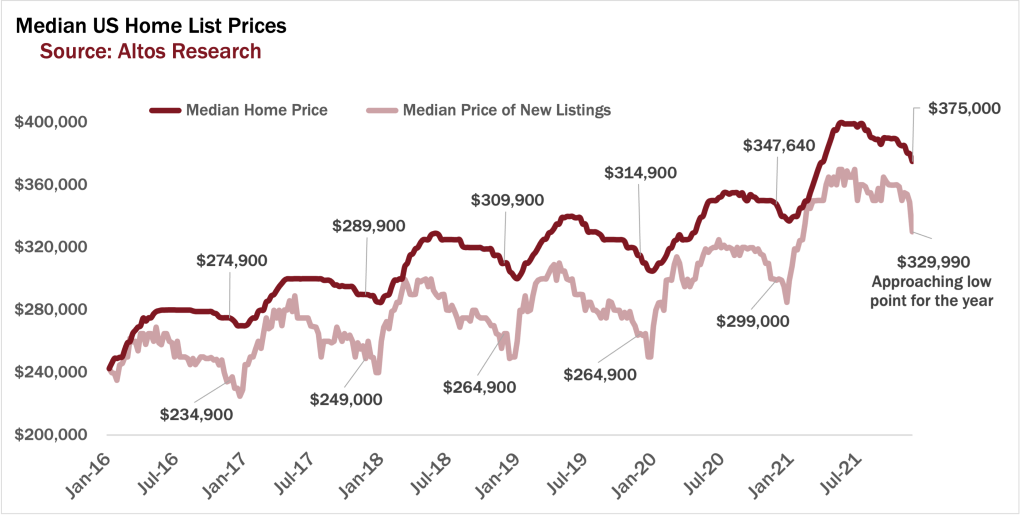

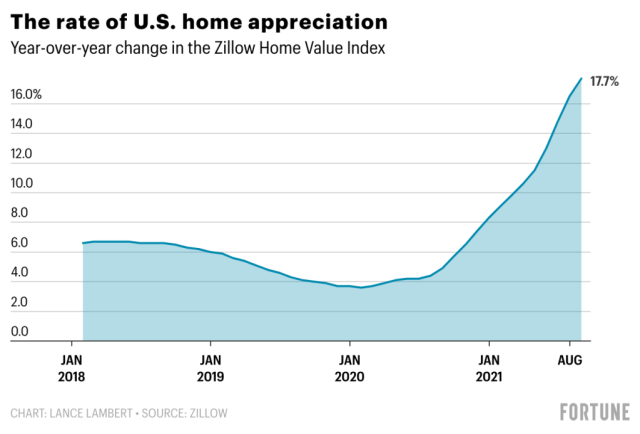

. With low inventory driving up housing prices and demand an increase in mortgage rates could slow things down. Already were starting to see home prices decelerate a bit. Most experts say housing demand will stay strong in 2022 unless inflation continues to outrun wages at the current feverish pace which could stall buyer appetite.

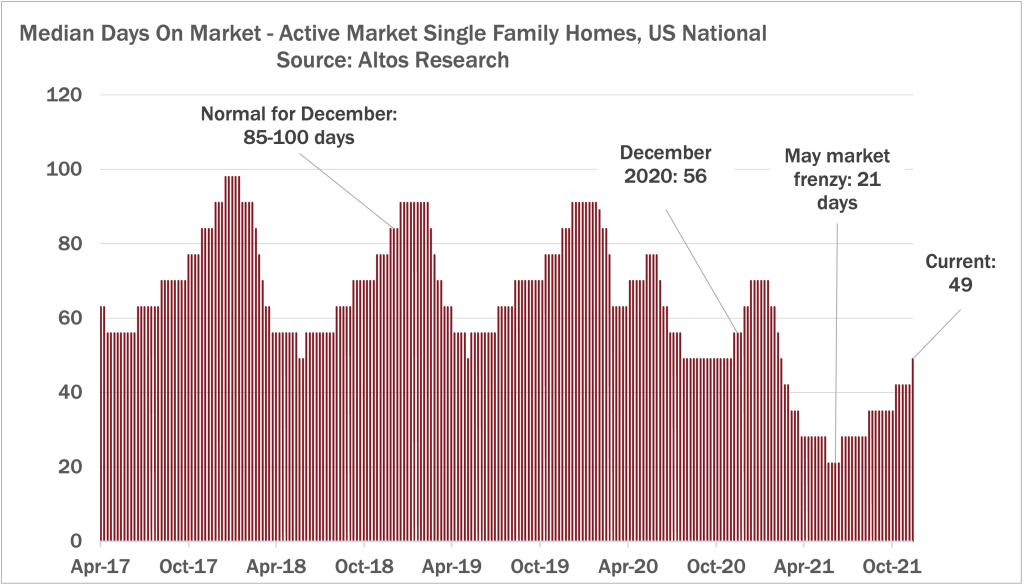

With the momentum coming out of this fall all signs point to the winter housing market picking up steam making it much busier than in a more typical year. The Spokane Association of Realtors December snapshot shows sales down 72 compared to this time last year but that doesnt mean the market is. Monday December 13th 2021 Wednesday December 15th 2021 KCM Crew For Buyers For Sellers Housing Market Updates From the opportunity to take advantage of todays low mortgage rates to changing homeowner needs Americans have more motivation than ever to buy a home.

Will the housing market slow down in 2022. It doubled again to 425 by December. And things got even worse with the SP 500 finally bottoming out on March 9 2009.

If it continues to increase Tully says it will slow down buyer demand. A real estate market crash in 2023 is a bit harder to speculate on. If You Think the Housing Market Will Slow This Winter Think Again.

Lots of demand and not a lot of inventory should persist through 2021 and beyond. Theres been a lot of hype in the news in summer 2019 that the slow down in the housing market is an indicator that the market may be heading for a housing crash. And as weve seen in so many ways 2020 and 2021 were anything but typical in real estate.

Home prices climbed a record 20. Between August 2020 and August 2021 US. Lucie Realtors and Zumper reveals a housing market thats.

If youre a prospective first-time homebuyer hoping or praying home prices will decline in 2022 most experts agree. Buyers are active in the market and are competing for homes to purchase. If you think the housing market will slow down this winter think again.

The short answer is no we DO NOT expect there to be a housing market crash next year and other real estate experts weve spoken with have expressed the same opinion. December 13 2021 From the opportunity to take advantage of todays low mortgage rates to changing homeowner needs Americans have. With the momentum that is coming out of the fall there is every indication that leads experts to believe that the winter housing market is picking up steam making for a much busier season than the typical year.

As we have seen in a plethora of ways 2020 and 2021 were anything but typical. Then again the opposite can be true when theres the risk that limited supply coupled with rising inflation could get so extreme that. As spring hits full stride a look at the latest data from the Broward Palm Beaches and St.

But over the following four months that 12-month growth. Real Estate Market Crash Coming Soon. The Great Recessions clobbering of the construction industry.

While not high by historical standards the increase will likely reduce the number of potential buyers says Chris. But again a housing market downturn in 2023 appears unlikely barring an unforeseen disruption to the nations economy. At least as of 3Q2020 we already experienced an aggressive 32 decline in the SP 500 in March 2020.

It looks like 2022 may be joining that list before we know it. It looks like 2022 may be joining that list before we know it. People who remember the subprime mortgage crisis are afraid that the increase in house prices followed by a slowdown is a sign that another housing bubble is about to burst.

And as weve seen in so many ways 2020 and 2021 were anything but typical in real estate. Freddie Mac and others are projecting rates will rise to 4 by the end of 2022. A vastly improved search engine helps you find the latest on companies business leaders and news.

Unfortunately many real estate agents report that rising mortgage rates mean the rush for homes is heating up again and they say that spring of. Different perspectives have been put forward in a bid to break down the events of the current housing market. The emergence of the huge Millennial generation in the 1980s made strong housing demand in the early 2020s entirely predictable.

The average 30-year-fixed rate mortgage in Nevada is currently at 48 49 percent according to US Bank.

The Housing Market Faces Its Biggest Test Yet Fortune

2022 Housing Market Forecast Another Boom Year Financial Samurai

How Long Can The Global Housing Boom Last The Economist

The Housing Market Faces Its Biggest Test Yet Fortune

Some Industry Experts Are Claiming That The Housing Market May Be Headed For A Slowdown As We Proceed Throu Real Estate Ads Real Estate Tips Real Estate Advice

Where Zillow Says Home Prices Are Headed In 2022

Pin On Tim Seyster Real Estate Agent Windermere Real Estate Ncw

Pin On Dayton Ohio Real Estate For Sale Group Board

What To Expect In This Wild Housing Market The New York Times

Will The Housing Market Continue Its Hot Streak In 2022 Housingwire

Will The Housing Market Continue Its Hot Streak In 2022 Housingwire

New Home Sales Miss Estimates But Housing Market Is Still Solid Theo Trade Housing Market New Homes Sale House

The Red Hot Housing Market Isn T Sustainable Corelogic Forecasts Home Price Growth To Slow

Where Zillow Says Home Prices Are Headed In 2022

California Housing Market Remains Resilient In January Despite Rising Interest Rates C A R Reports

How Long Can The Global Housing Boom Last The Economist

Real Estate Blog Investment Advice Cash Out Refinance Real Estate

Forecast California Home Prices Will Slow Down Not Drop In 2022